- Home

-

About us

-

Management Team

-

Your Vision, Our Expertise.

At ConsultEdge, our management team embodies a blend of experience, innovation, and dedication. Guided by a collective vision to drive transformative change, they lead with expertise across diverse domains, ensuring every client journey is marked by excellence and innovation. With a focus on optimizing processes and empowering our teams, our leaders ensures that our operations are aligned with our vision for success.

-

-

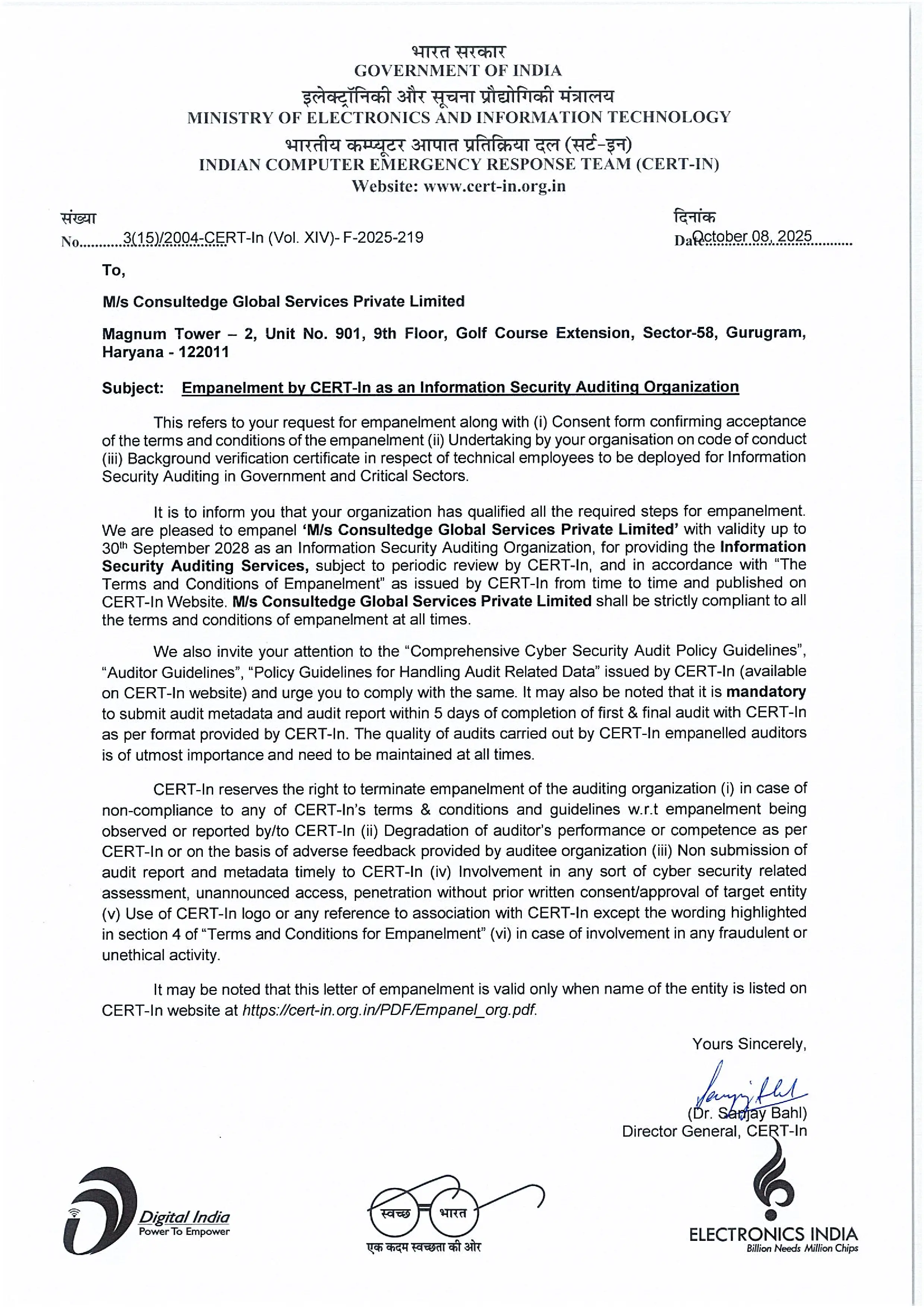

Awards & Accolades

-

Your Vision, Our Expertise.

At ConsultEdge, our dedication to excellence has been recognized by industry leaders and peers alike. From industry-specific recognitions to regional and global honors, each award serves as a testament to the hard work and dedication of our team. As we continue to push the boundaries of what's possible, we are proud to showcase our achievements and celebrate the milestones that mark our journey toward continued success.

-

-

Our Partners

-

Your Vision, Our Expertise.

Discover the strength of our alliances with industry leaders across diverse segments at ConsultEdge. Together, we drive transformative change and create opportunities worldwide.

-

-

Our Clients

-

Creating Value, Delivering Excellence

Our diverse clientele includes forward-thinking businesses, from startups to industry leaders, who rely on us to guide them through the complexities of risk management and technology integration.

-

-

Careers

- Pioneering Paths to Prosperity Ready to embark on a rewarding journey in IT? Explore exciting career opportunities with us and join our dynamic team. Your future starts here.

-

Services

-

Beyond Consulting: We Execute

-

Beyond Consulting: We Execute

-

Translating Visions into Results

-

Translating Visions into Results

-

Analysis, Solutions, Results!

-

Analysis, Solutions, Results!

-

- Insights

- Contact us

-

-

IndiaUSAUKIndia (en)India (hi)Saudi ArabiaUAEFranceSpainGermany