Enterprise IT Transformation for Financial Services Provider – AI-Driven Debt Collection Case Study

ConsultEdge.Global enabled Visionary Peak Pvt. Ltd. to scale outbound debtor engagement using AWS cloud services, AI-driven automation, and secure serverless architectures.

About the Client

Visionary Peak Pvt. Ltd. is an enterprise financial services company specializing in debt collection and receivables management. Operating across India, the organization manages large portfolios of delinquent accounts for multiple clients, with a strong emphasis on regulatory compliance, data security, and technology‑driven recovery outcomes.

Visionary Peak positions itself as a modern, scalable service provider leveraging cloud and AI to improve operational efficiency and customer engagement.

What Was the Challenge?

Visionary Peak faced increasing pressure to scale outbound debtor communications while maintaining strict compliance and service quality. Existing manual and semi‑automated processes created operational bottlenecks and limited growth.

Inability to scale outbound calling to enterprise volumes

Inability to scale outbound calling to enterprise volumes

High dependency on manual workflows and Excel-based data handling

High dependency on manual workflows and Excel-based data handling

Regulatory risk due to lack of automated legal-script verification

Regulatory risk due to lack of automated legal-script verification

Limited real-time visibility into call quality and disputes

Limited real-time visibility into call quality and disputes

Increased exposure to data errors and delayed engagement

Increased exposure to data errors and delayed engagement

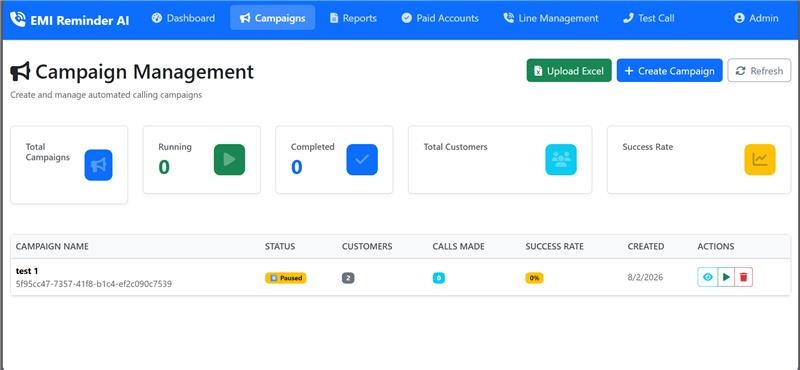

Solutions Offered

Secure, Cloud-Native, AI-Driven Contact Center on AWS

ConsultEdge.Global designed and implemented a secure, cloud‑native, AI‑driven contact center solution on AWS, aligned with financial‑services compliance and scalability requirements.

Enterprise IT and contact‑center consulting

Enterprise IT and contact‑center consulting

Cloud‑native architecture using AWS managed services

Cloud‑native architecture using AWS managed services

AI‑powered voice automation and conversational interfaces

AI‑powered voice automation and conversational interfaces

Secure data ingestion, processing, and reporting pipelines

Secure data ingestion, processing, and reporting pipelines

Compliance, audit, and security enablement

Compliance, audit, and security enablement

Scalable serverless backend implementation

Scalable serverless backend implementation

Step-by-Step Approach to Enterprise IT Transformation

Assessment and Strategy Development :

Conducted a detailed assessment of outbound debt‑collection workflows, regulatory obligations, data‑handling practices, and future growth targets. Defined an AI‑first, cloud‑native strategy aligned with business and compliance objectives.

Assessment and Strategy Development :

Conducted a detailed assessment of outbound debt‑collection workflows, regulatory obligations, data‑handling practices, and future growth targets. Defined an AI‑first, cloud‑native strategy aligned with business and compliance objectives.

Architecture Design and Service Selection

Designed a cost‑optimized AWS architecture leveraging Amazon API Gateway, AWS Lambda, Amazon S3, Amazon RDS (MariaDB), and a minimal EC2 footprint to balance scalability, performance, and operational control.

Architecture Design and Service Selection

Designed a cost‑optimized AWS architecture leveraging Amazon API Gateway, AWS Lambda, Amazon S3, Amazon RDS (MariaDB), and a minimal EC2 footprint to balance scalability, performance, and operational control.

-

AI‑Driven Voice and Speech Automation

AI‑Driven Voice and Speech Automation

Amazon Transcribe for speech‑to‑text analytics in multiple Indian languages, enabling quality monitoring and compliance verification

Amazon Transcribe for speech‑to‑text analytics in multiple Indian languages, enabling quality monitoring and compliance verification Amazon Polly with neural voices for text‑to‑speech in 10+ languages, enabling personalized and culturally appropriate debtor communication at scale

Amazon Polly with neural voices for text‑to‑speech in 10+ languages, enabling personalized and culturally appropriate debtor communication at scale Language auto-detection to seamlessly switch between languages based on debtor preference

Language auto-detection to seamlessly switch between languages based on debtor preference

Advanced NLP and Sentiment Intelligence

Advanced NLP and Sentiment Intelligence

Real-time sentiment analysis using Amazon Comprehend to detect debtor emotional state (positive, negative, neutral, mixed)

Real-time sentiment analysis using Amazon Comprehend to detect debtor emotional state (positive, negative, neutral, mixed) Emotion classification identifying frustration, anxiety, willingness to pay, or resistance

Emotion classification identifying frustration, anxiety, willingness to pay, or resistance Intent recognition to understand debtor objectives (dispute, payment plan request, hardship claim, etc.)

Intent recognition to understand debtor objectives (dispute, payment plan request, hardship claim, etc.) Dynamic tonality adjustment: AI automatically modifies conversation tone—from empathetic to assertive—based on detected sentiment and engagement level

Dynamic tonality adjustment: AI automatically modifies conversation tone—from empathetic to assertive—based on detected sentiment and engagement level Context-aware response generation ensuring appropriate, compliant, and effective communication

Context-aware response generation ensuring appropriate, compliant, and effective communication

Intelligent Automation Using Generative AI

Intelligent Automation Using Generative AI

AI‑powered call summarization with sentiment and outcome tagging

AI‑powered call summarization with sentiment and outcome tagging Automated dispute classification and priority scoring

Automated dispute classification and priority scoring Intelligent dispositioning with payment probability prediction

Intelligent dispositioning with payment probability prediction Agent‑assist capabilities with real-time prompts based on conversation flow and detected sentiment

Agent‑assist capabilities with real-time prompts based on conversation flow and detected sentiment Sub-second response time optimization ensuring natural conversation cadence and improved debtor experience

Sub-second response time optimization ensuring natural conversation cadence and improved debtor experience

Secure Data Management and Integration

Secure Data Management and Integration

Structured data stored in Amazon RDS

Structured data stored in Amazon RDS Unstructured assets (call audio, transcripts, sentiment logs) stored in Amazon S3

Unstructured assets (call audio, transcripts, sentiment logs) stored in Amazon S3 All data protected by encryption and granular access controls

All data protected by encryption and granular access controls

Compliance, Security, and Audit Readiness

Compliance, Security, and Audit Readiness

Role‑based access control and multi‑factor authentication

Role‑based access control and multi‑factor authentication Centralized logging with sentiment and tonality tracking for quality assurance

Centralized logging with sentiment and tonality tracking for quality assurance Encryption at rest and in transit

Encryption at rest and in transit Immutable audit trails capturing conversation analytics, language used, and compliance verification

Immutable audit trails capturing conversation analytics, language used, and compliance verification Regulatory compliance assurance for debt collection practices

Regulatory compliance assurance for debt collection practices

RESULT

The AI‑powered contact‑center platform enabled Visionary Peak to automate and scale its outbound debt‑collection operations, supporting up to 200,000 personalized calls per day across 10+ languages. Key measurable outcomes:

35% reduction in average handling time through intelligent automation and optimized response generation

35% reduction in average handling time through intelligent automation and optimized response generation

42% improvement in debtor engagement rates via sentiment-aware, culturally appropriate multilingual communication

42% improvement in debtor engagement rates via sentiment-aware, culturally appropriate multilingual communication

60% faster dispute resolution enabled by real-time NLP and automated classification

60% faster dispute resolution enabled by real-time NLP and automated classification

Zero compliance violations through automated script adherence and complete audit trails

Zero compliance violations through automated script adherence and complete audit trails

Real-time sentiment dashboards providing supervisors with actionable insights into call quality and escalation triggers

Real-time sentiment dashboards providing supervisors with actionable insights into call quality and escalation triggers

Conclusion

This case study highlights how a structured enterprise IT transformation—built on AWS cloud services, AI‑driven automation, and strong security controls—can modernize high‑volume, regulated financial contact‑center operations.

By partnering with ConsultEdge.Global, Visionary Peak Pvt. Ltd. achieved a scalable, compliant, and future‑ready debt‑collection platform that supports sustainable growth and operational excellence.